Flat Owners Guide to Extending The Lease

Introduction

Owning a leasehold refers to renting a property for a limited period of time, for a specified rent and on the terms contained within the lease. You may also be subject to a service charge for the repair and maintenance of the common areas of the building, the estate and insurance.

Historically, flat leases were usually for a term of at least 250 years with a peppercorn ground rent (essentially, no ground rent). However, after the 2008 property crash, developers sought new ways of generating income for properties they ended up selling for less than the price they had projected when the market was at its highest. This was typically achieved by granting a shorter lease of between 99 – 250 years and reserving a higher ground rents that increase periodically.

You may have seen the horror stories in the news about leasehold owners being unable to sell or re-mortgage their apartments or houses because of a short lease term or onerous ground rent terms. This is a growing issue throughout the country and our dedicated team of experts are on hand to help you.

The Lease Extension Team at Monarch Solicitors have put together this brief guide on the basics of extending your lease. The scope of this guide will deal with the widely applicable approach found in the Leasehold Reform, Housing and Urban Development Act 1993.

We hope you find our TOP 10 FACTS GUIDE on lease extensions for flats useful. 1.

1. Voluntary or Informal Lease Extension Option

Any leaseholder, whether or not they qualify for the statutory right to extend their lease, can negotiate informal lease extension with an open market deal with the landlord.

Advantages

- The premium payable, the length of the extension and any changes to the covenants or terms are all negotiated freely.

- The process can be quicker as there are no restrictions over timing. An extension can be arranged can happen immediately if both parties are willing; saving time and costs.

- The leaseholder has the alternative to ‘top-up’ the lease to any term desired for a smaller premium rather than buying the freehold, if they simply want to make the property attractive to potential buyers.

- The leaseholder doesn’t have to buy any intermediate landlords’ interest.

Disadvantages

- The leaseholder is not protected by the statutory safeguards relating to the calculation of the purchase price and any intermediate landlords’ interests.

- Either party or intermediary interest can withdraw from the process at any time until the contract is concluded, regardless of whether time and money has already been spent.

- If an agreement cannot be reached on the terms, there is no recourse to the Tribunal without first triggering the statutory process.

- Generally, the price payable is higher as the lease is negotiated on the open market.2.

2. Statutory Lease Extension Option

Qualifying leaseholders have a legal right under the Leasehold Reform, Housing and Urban Development Act 1993 (LRHUDA 1993) to extend their lease for 90 years and a peppercorn ground rent.

Advantages

- The statutory safeguards compel the landlord to extend the lease; they cannot refuse if you satisfy the criteria.

- The safeguards govern the purchase price payable, and limit the costs that the landlord is entitled to recover.

- If an agreement cannot be reached there is recourse to the Tribunal for an independent determination.

- A statutory timetable must be followed, but it provides the leaseholder time to arrange the funds for the purchase.

Disadvantages

- From the service of the Tenant’s Notice, the process can take 6-9 months.

- Both parties are locked into the process: the tenant must extend their lease and pay the resulting costs

- The eventual purchase price is not guaranteed at the outset.

- If the landlord challenges the tenant’s eligibility after the notice is served, this litigatory aftermath is costly.

- The deposit is non-refundable but deductible from the purchase price.

The Qualification Criteria

In order to exercise the statutory right to extend the lease under the LRHUDA 1993, there are three main criteria that must be satisfied:

The building must be a ‘flat’

“Flat” in this case is widely defined, to include a lease of whole or part of a building and includes common parts. Certain public buildings are excluded.

The lease must qualify

The lease must have originally been granted for a term of more than 21 years, unless it contains a right of perpetual renewal, is terminable on the death/marriage of the tenant or an unknown date, or where the tenant has held over at the expiry of a long lease. A shared ownership lease will qualify where the tenant owns 100%.

The lease must not be an “excluded” tenancy, such as a business tenancy but this does not preclude corporate tenants from exercising the right.

The tenant must qualify

The tenant must be a registered owner at Land Registry for more than 2 years and there can only be one qualifying tenants per flat, so if the tenant has underlet the flat on a long lease, the undertenant may qualify.

Mixed-Use Buildings

In addition, in a mixed-use building (for example a building comprising a shop with a flat above), a tenant can only extend their lease:

- the tenancy was granted for a term of more than 35 years; and

- the flat was occupied as his/her only or main residence for two years or periods amounting in aggregate to two years in the preceding ten years.

4. Transferring the Right to Extend

If you are looking at purchasing a leasehold property but are concerned about the lease term or ground rent, you should take early legal advice form a specialist so as to not cause delays.

There may be opportunity for you to negotiate a lower purchase price with the current owner to take into account the cost of extending the lease and you may be able to bypass the 2 year wait to accrue the statutory right to extend.

A seller may be able to serve the statutory Section 42 Notice of Claim and then transfer the benefits and responsibilities of the notice by a Deed of Assignment to the buyer.

Timing for the Notice of Claim

The Section 42 Notice of Claim needs to be served before exchange takes place, otherwise the seller will not be satisfying the ownership test. This is a sensitive transaction as the lease and the notice must be assigned together, therefore ideally you should you should use the same solicitor for the conveyance and lease extension.

5. Price and Valuation of the Premium

Calculating the Premium

The “premium” is the price payable to the landlord (and any intermediate landlords) for the lease extension and is calculated under the criteria set out in Schedule 13, Part II, LRHUDA 1993. This compensates the landlord for the loss of rent for the remainder of the term of the existing lease and for being kept out of its reversion for the additional 90 years. The premium is calculated using a number of assumptions and yield and deferment rates.

The 80 Year Trap

Crucially, once there are 80 years or less remaining on the lease term, the value of the freehold increases substantially. This is because the lease extension premium attracts a ‘marriage value’; essentially the difference between the value of the landlord’s and tenant’s interest in the flat with the existing lease and the value of the landlord’s and tenant’s interest in the flat with the new lease. The premium payable to the landlord will include 50% of the marriage value.

A lease of less than 80 years becomes less marketable as buyers will be wary of the cost issues and the high-street mortgage lenders will not lend against such a short term. Therefore, if you have a leasehold of less than 125 years, you should think about extending your lease as early as possible.

Don’t wait to the 11th hour!

The Valuation Report

Before setting out on the statutory lease extension procedure, it is vital to obtain a professional valuation report from a RICS chartered surveyor and in accordance with the RICS Leasehold Reform in England and Wales Professional Guidance Note.

The valuation will provide:

- An indication of the premium before committing to the lease extension process

- Leverage for negotiations with the landlord

- Information required to complete the Section 42 Notice of Claim

- Expert evidence of the reasonable premium payable in any Tribunal proceedings

Landlords Valuation

The landlord will usually instruct their own valuer and you will be liable to pay the costs of both valuations.

The Valuation Date

The lease extension premium value is set on the date the Section 42 Notice is served and any fluctuations in the market that may be relevant to value that occur after that date are to be disregarded. Therefore, it is not in the landlord’s interest to prolong the process of agreeing or determining the terms of the lease extension.

Need help extending your lease? Visit our Leasehold Extension Page

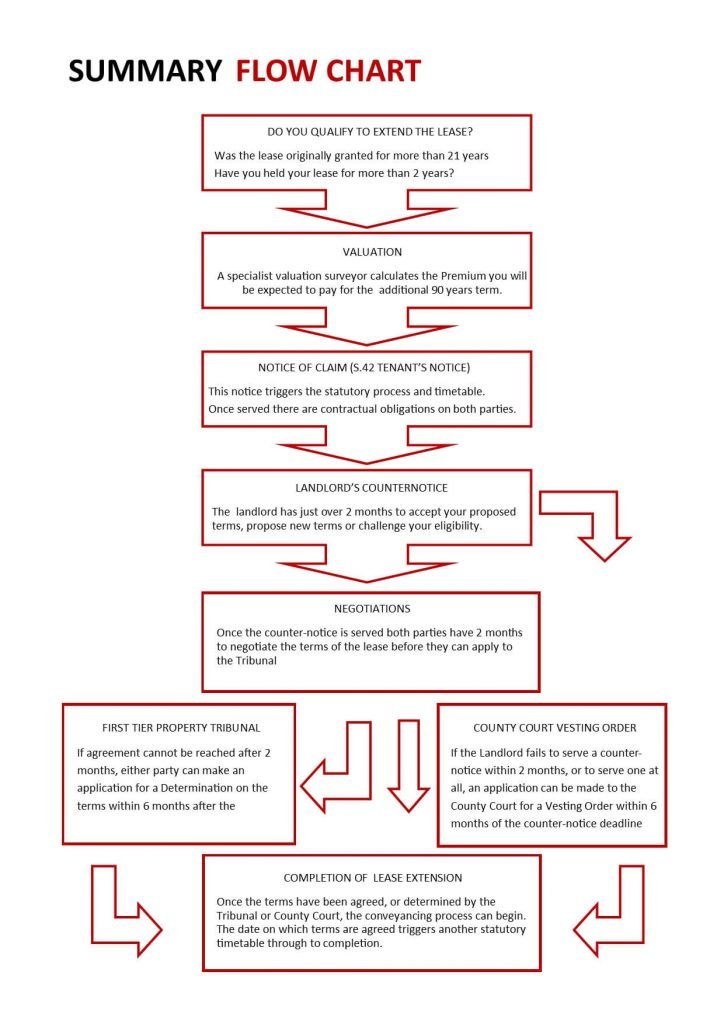

6. The Statutory Procedure

LRHUDA 1993 provides qualifying leaseholders the ability to extend their lease on the following terms:

- An additional 90-year term to the unexpired term. For example, if you have 50 years left to run on your lease, after the lease extension you will end up with a lease with an unexpired term of 140 years

- A lease on exactly the same terms as that which you have at the moment (subject to minor up-dating) and

- All for a “peppercorn rent” (i.e. nil rent for the remainder of the term).

Section 42 Notice of Claim:

The notice triggers the statutory process to acquire a new lease. The notice must contain information specified by statute, including, the full name of the tenant(s), the address of the flat, the details of the lease, the terms for the proposed lease and the premium the tenant proposes to pay and any other amounts proposed to be paid to other landlords. If the amounts payable to the different landlords are not separately stated, the initial notice will be invalid. The notice can be signed by the tenants or on their behalf.

Service of Section 42 Notice

The Notice of Claim must be served on the competent landlord, intermediate landlords and any third party to the lease, such as a management company or guarantor. A tenant can apply to the court for an order to dispense with the service of the initial notice on any other landlord so long as the identity and whereabouts of the competent landlord is known. The initial notice must specify that the court has made such an order.

Effect of Serving the Section 42 Notice:

The statutory procedure is started, the Tenant is liable to pay the competent/intermediate landlord’s costs and the valuation date for the premium payable is set.

The Process After Service of the Notice (in brief):

- The Notice of Claim is registered at Land Registry as a notice or Land Charge

- The landlord may require payment of a deposit of either £250 or 10% of the proposed premium (whichever is the greater).

- The landlord may require payment or an undertaking for its costs, valuation fees, solicitor’s fees and the cost of a lease plan.

- The tenant must allow the landlord to inspect the flat to carry out a valuation.

- Within 2 months of the Notice of Claim, the landlord must serve a counter notice either admitting or denying the claim or make an application to the court for an order that a new lease is not granted on the grounds of redevelopment.

- If the claim is not admitted then the tenant has 6 months to dispute the rejection through the courts to make an order for the grant of a new lease.

- Parties negotiate the terms of acquisition, i.e. lease terms (but not the form of lease, lease plan, the premium) or if terms cannot be agreed, either party may make a Tribunal application for determination within the set time frame of 2-6 months following the service of the counter notice.

- Once the terms of acquisition have been agreed or determined, the parties have 2 months to complete the lease.

- If the lease is not completed within this time, there is a 2 month period in which either party must make an application to the court for an order for performance/discharge, otherwise the tenants notice of claim is deemed withdrawn.

7. The Competent Landlord

The competent landlord is the person who will grant the new lease and progress the claim for the lease extension on behalf of all intermediate landlords. Any action taken by the competent landlord is binding on the other landlords. The competent landlord must have:

- An interest in reversion (immediate or not) on the expiry of the tenant’s existing lease;

- with a sufficient duration to grant the tenant a new lease for a term incorporating the residue of the term of the tenant’s current lease plus an additional 90 years.

Missing landlords:

If the competent landlord cannot be found, the tenant can apply to the county court for a vesting order for a new lease to be granted on terms determined by the Tribunal and payment of the premium into court.

8. Information & Default Notices

Information notices

If there is any uncertainty about the interests in the flat that are superior to the tenant’s interest, the tenant has a right to serve a notice on the freeholder, its landlord (if different from the freeholder) or any other person with an interest in the property, requesting details of that interest.

The recipient of the notice should respond within 28 days to provide the name and address to the tenant of any intermediate interest between the tenant and the recipient of the notice and the terms of that interest. The tenant can also ask to see a copy of the intermediate lease.

Default Notice Procedure

If there is no response to the information notice, the tenant can engage the default notice procedure which our experts can help you with.

Download our Free Extending the Lease Guide

9. Landlord’s Right to Redevelop

Landlords right to Possession

The landlord has a right to include a clause in the new lease reserving a right to obtain possession of the flat on the grounds of redevelopment.

The right is exercisable in the 12 months ending on the expiry date of the existing lease, and in the last five years of the term of the new lease.

A deduction to the premium can be made for the landlord’s right to redevelop. The landlord could waive its rights to include the reservation to redevelop in the new lease and this deduction would then not be relevant.

Landlords right to refuse Lease Extension

Where the lease of the flat is due to terminate within five years of the Notice of Claim, the landlord can serve a counter notice stating that he intends to redevelop the property. He must then apply to the court within two months of the date of the counter notice for an order that a new lease is not granted.

The right can only be exercised pursuant to a court order and the landlord must persuade the court that it intends to demolish, reconstruct or carry out substantial works of reconstruction on the whole or a substantial part of the premises of which the flat forms part. The tenant is entitled to compensation if the landlord obtains possession of the flat.

The court has a discretion to order a new lease of the flat, even if the landlord is able to prove it has an intention to develop.

10. Withdrawal from the Statutory Procedure & Costs

Deemed Withdrawal

A claim is deemed to be withdrawn:

-

- If the tenant fails to make a vesting order application within six months of the date the landlords counter notice was due;

- If the tenant fails to make an application to the Tribunal within 6 months of the landlord’s counter notice admitting the claim and the terms of acquisition for the new lease have not been agreed.

- If no application is made to the county court within two months after the expiry of the “appropriate period”, i.e.: the period of two months following a final court order for a grant of a new lease if the landlord fails to serve a valid counter-notice

- If the lease is assigned to a buyer without the benefit of the notice.

- If the court orders that the claim is withdrawn pursuant to an application under section 48(4) of the LRHUDA 1993; an order made two months after when terms of acquisition were finally agreed between the landlord and tenant.

- If the court orders that the claim is deemed withdrawn pursuant to an application under section 49(5) of the LRHUDA 1993.

Tenant Withdrawal

The tenant may also unilaterally withdraw the initial notice if it decides not to proceed with the lease extension. The tenant can give a notice of withdrawal at any point before the lease is entered into.

Effect of Withdrawal

If the tenant’s application for a lease extension is withdrawn (whether intentionally or deemed) the tenant cannot make another application for a new lease for a period of 12 months from the date of withdrawal. A twelve-month delay will likely result in an increased premium being paid by the tenant.

Costs and Tenants Deposit

If the tenant’s notice is withdrawn, deemed to have been withdrawn, or otherwise ceases to have effect, the tenant can require the landlord to return the deposit.

However, the tenant will be liable for the landlords’ costs (including intermediate landlords) upon withdrawal.

The landlord is entitled to deduct from the deposit any amount due to him from the tenant in respect of his costs and if the deposit is not sufficient to cover those costs the leaseholder will have to cover those additionally.

11. Advantages of a Statutory Lease Extension

A lease extension negotiated under the voluntary route gives significant power to the freeholder, leaving them unrestricted to charge higher premiums on worse terms compared to the statutory route.

Where there is an intermediate lease, LRHUDA 1993 provides for there to be a notional surrender and regrant of the intermediate lease, to allow the freeholder the right to grant the new lease and then regrant the intermediate lease.

Where there is an intermediate lease in the voluntary route, the freeholder does not have the capacity to accept a surrender of the tenant’s existing lease or grant a new lease. The right to do this rests with the intermediate landlord and if he is not involved a complicated leasehold structure is created.

Intermediate leases can cause difficulties in the voluntary route, since each interest will have their own priorities and requirements. If one interest pulls out of the agreement, you may be left with two mistimed leases that will cause difficulties in mortgaging and selling the flat when this is discovered.

Increase your flats value and marketability. Most lenders will not lend against a short lease because of the risk they face in recovering their security. This limits the number of potential buyers and most potential buyers will be reluctant to have to spend additional monies on the property either to extend the lease.

Advantages for the Landlord – The landlord will be entitled to roll over relief on the premium of the new lease if the LRHUDA 1993 is followed.

Mortgages – The legislation provides that in most cases a deed of substituted security will not be required. If the LRHUDA 1993 procedure is not used to grant the new lease, a deed of substituted security will be required.

12. Extending a House Lease

This right has been little exercised in recent years because the right to buy the freehold has been expanded to include most houses and is usually the preferred option for the tenant.

- A qualifying tenant of a long lease of a house also has the right to the grant of a new lease for the remainder of the existing term plus a further 50 years.

- No premium is payable, but the lease can contain a modern ground rent, reviewable after 25 years.

- The determination of the modern ground rent cannot be made until 12 months before that rent is to become payable (12 months before the date that would have been the expiry date of the original lease). The modern ground rent is calculated as the letting value of the site, without the house.

- The new lease will be a substitute for the remainder of the original lease, which will be surrendered by operation of law (as determined in Lewis (Jenkins R) & Son v Kerman [1971]).

- The terms of the new lease other than the rent and the term are generally the same as the terms of the existing lease, although these can be changed either by agreement or if something has happened since the date of the existing lease which affects the suitability of a provision of the original lease.

- The provisions of the Landlord and Tenant Act 1927 (LTA 1927) that allow the landlord and tenant to agree conditions for consent to an assignment and the circumstances in which consent may be withheld, do not apply to residential leases.

- A tenant who has been granted a lease extension is entitled to exercise its right to buy the freehold both before and after the end of the term of the original lease.

- Where the notice of tenant’s claim is served after the end of term date of the original lease, the valuation basis is the special valuation basis and section 9(1C) but with modified assumptions, even if the lease qualifies for the original valuation basis.

- If the tenant takes a lease extension but does not choose to enfranchise, the tenant cannot simply extend the lease again when it ends. The tenant does, however, have the right to an assured tenancy.