Buying the Freehold – House Owners Guide

Introduction:

Historically the word “enfranchisement” meant “liberation from imprisonment or slavery” in relation to people. Used in the modern-day context of property ownership, “enfranchisement” refers to the release from control by the freeholder.

Owning a leasehold refers to renting property for a limited period of time, for a specified rent, and on terms contained in the lease. Like the terms of any contract, if the terms of the lease are breached then there are consequences. However, in contrast, a freehold grants legal ownership and control for an unlimited period of time.

Freeholders, often with minimal investment, have significant potential power over a leaseholder, including ultimately the power of forfeiture (where the entire property is seized).

This guide is for leasehold homeowners who are assessing their options on purchasing their freehold. It primarily covers the statutory enfranchisement process although the voluntary route and extending the lease options are covered in brief also.

We hope you find our Top 10 Facts Guide on purchasing the freehold useful.

If you have any further questions, please contact our specialist Leasehold Team.

1. Voluntary Route

Any leaseholder, whether or not they qualify for the statutory right to purchase their freehold, can negotiate an open market deal with the landlord.

Advantages of voluntary freehold purchase:

- The parties can freely negotiate the terms, the purchase price and other associated costs.

- The process can be quicker as there are no restrictions over timing: it can happen immediately if both parties are willing.

- The leaseholder has the alternative to ‘top-up’ the lease to any term desired for a smaller premium rather than buying the freehold, if they simply want to make the property attractive to potential buyers.

- The leaseholder doesn’t have to buy any intermediate landlords’ interest.

Disadvantages of voluntary freehold purchase:

- The leaseholder is not protected by the statutory safeguards relating to the calculation of the purchase price, terms and any intermediate landlords’ interests.

- Either party can withdraw from the process at any time until the contract is concluded, regardless of whether time and money has already been spent.

- If an agreement cannot be reached on the terms, there is no recourse to the Tribunal without first triggering the statutory process.

- Generally, the price payable is higher as it is being bought/sold on the open market.

2. Statutory Route

Qualifying leaseholders have a legal right under the Leasehold Reform Act 1967 to buy their freehold and any intermediate leases.

Advantages of statutory freehold purchase:

- A statutory timetable must be followed, but it provides the leaseholder time to arrange the funds for the purchase.

- Statutory safeguards which compel the landlord to sell the freehold, govern the purchase price payable, and limit the costs the landlord is entitled to recover.

- If an agreement cannot be reached there is recourse to the Tribunal for an independent determination.

Disadvantages of statutory freehold purchase:

- From the service of the Tenant’s Notice, the process can take 6-12 months.

- Both parties are locked into the process: freeholder/leaseholder must sell/ buy.

- The eventual purchase price is not guaranteed at the outset.

- Costs: even if he withdraws, the leaseholder is liable for the freeholder’s costs, surveyor’s fees and legal costs.

- The landlords deposit is non-refundable.

3. Statutory Route

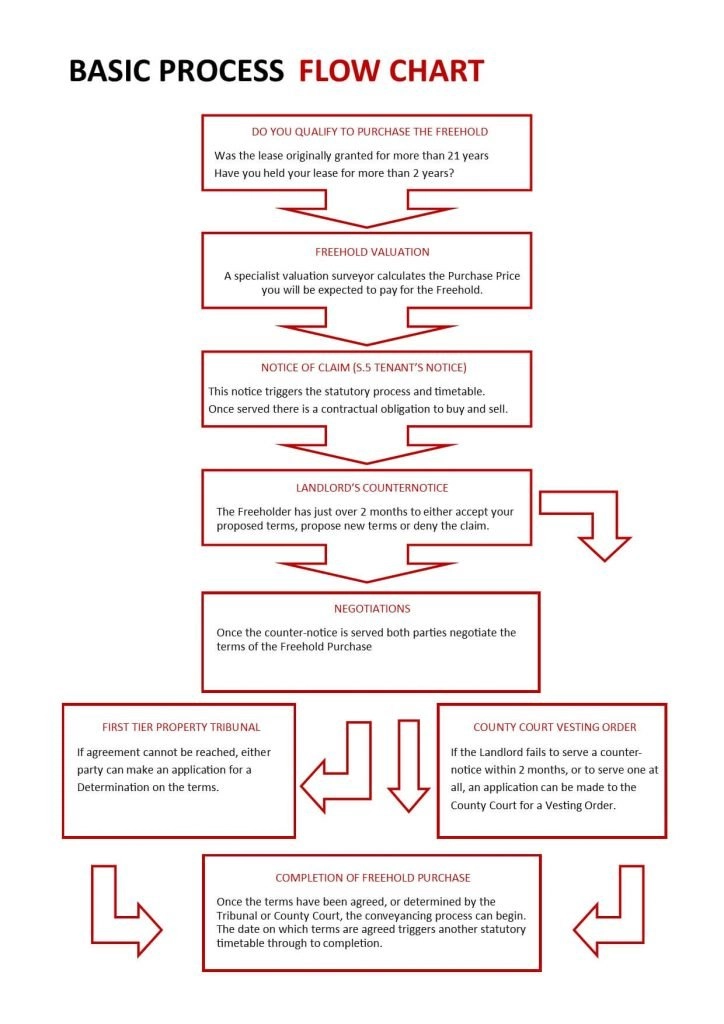

Section 5 Notice of Claim:

This is a prescribed form and must state: whether the tenant is claiming either the freehold or an extended lease; the details of all persons upon whom a copy is served; a description of the house and any ancillary land/buildings, details of the lease and its acquisition; details of residency (if applicable), details of the rent; the basis of valuation and the premium; and, where the tenant seeks to rely on a site-only valuation, details of the rateable value. The notice must be signed by all the tenants or their authorised agent.

Service of Notice:

The Notice of claim must be served on the freeholder, any intermediate landlords, and any party that has an interest in the property superior to tenant’s own. The notice of tenant’s claim must be served in accordance with section 23(1) of the LTA 1927 in order to be valid.

Effect of Serving the Notice:

- Creates a statutory contract between the landlord and the tenant in which the tenant is bound to buy the freehold (or take a new lease) and the landlord is bound to sell the freehold (or grant a new lease).

- The existing lease continues automatically until the expiry of a period of three months after the end of the “currency of the claim”.

The Process After the Notice of Claim has been served (in brief):

- The landlord can serve a notice requiring the tenant to provide the following within 21 days: payment of a non refundable deposit of either £25 or 3x the ground rent (whichever is greater); deduction of title; and a statutory declaration in relation to the residency test.

- The landlord may require an undertaking for its costs, valuation fees and solicitor’s fees, as the tenant is liable to pay these.

- Within 2 months of the Notice of Claim, the landlord must serve a counter notice either admitting or denying he claim.

- If the claim is admitted or the landlord fails to reply, the tenant can serve a notice requiring the landlord to deuce title within 4 weeks.

- Each of the landlord and the tenant can serve a notice on the other stating any rights of way and restrictive covenants they require in the transfer, and the notice must include details of any matters they wish themselves to include. Each party has 4 weeks to respond.

- If the claim is denied, the landlord has 2 months to issue a claim in the court and the tenant will have to defend the proceedings.

- If the landlord fails to respond at all, the tenant will need to isse a claim for a vesting order.

- There are no strict time limits to negotiate the price and terms of the conveyance.

- Once the terms of the conveyance and the purchase price have been agreed (or determined by the Tribunal or County Court), the freehold is transferred through a conveyancing and proceeds to completion.

Statutory Enfranchisement Process Flowchart:

4. Qualifying Criteria

In order to exercise the statutory right to buy the freehold under the Leasehold Reform Act 1967, there are three main criteria that must be satisfied:

1. The building must be a ‘house’

“House” in this case is widely defined, to include a building designed or adapted for living in (even if it is not detached). However, there must be no material over- or under-hang with an adjoining building (which would suggest that the property is a flat), and it must not be a building used for commercial purposes.

2. The lease must qualify

The lease must comprise the whole of the house and it must be a long lease of more than 21 years. A shared ownership lease will qualify where the tenant owns 100%. The lease must not be an “excluded” tenancy (i.e. a house in a designated protected area where the freehold has been owned with adjoining land occupied for commercial purposes and the lease was granted for a term of 35 years or less).

3. The tenant must qualify

The tenant must be a registered owner at Land Registry for more than 2 years.

Residency Test in mixed-use buildings

In addition, in a mixed use building (for example a building comprising a shop with a flat above), a tenant can only buy the freehold if:

- the tenancy was granted for a term of more than 35 years; and

- the house was occupied as his/her only or main residence for two years or periods amounting in aggregate to two years in the preceding ten years.

5. Ancillary Land & Buildings

The right to buy or extend the lease applies to any appurtenances (within the curtilage of the house), garage, outhouse, garden or yard which are let to the tenant and which satisfy the “qualifying condition”.

The “qualifying condition” is that, at the date on which the tenant serves the notice of claim, the ancillary premises must be let to the tenant with the house (by the same landlord.

The case of Gaidowski v Gonville & Caius College, Cambridge [1975] confirmed that the premises must have been let as part of the same transaction as the original lease or by way of subsequent addition to the original lease (such as the grant of a supplemental lease for the residue of the original term).

The ancillary premises lease must also be a long lease of more than 21 years.

Thinking of purchasing your freehold? Find out how we can help

6. Freehold Purchase Price & Premium

A purchase price is paid by the tenant to the landlord (and any intermediate landlords) to acquire the freehold. The purchase price is based on the value of the freehold as at the date of service of the notice of the tenant’s claim.

There are two main approaches to establishing the purchase price:

(1) the original valuation basis; and

(2) the special valuation basis.

Under both bases it is assumed that the sale is taking place in an open market between a willing seller and a willing buyer.

Section 9 of the LRA 1967 sets out the specific assumptions which apply in assessing the open market value in differing circumstances.

Section 9(1):

If the house qualified pre-1993 (i.e. because it was not necessary to rely on amendments to the financial limits and/or low rent conditions made by any of the 1993, 1996, or 2002 Acts) and had a rateable value of less than £1,000 (or £500 outside the Greater London area) on 31 March 1990.

This excludes “marriage” value (see below). The valuation is a proportion of the value of the land.

Section 9(1A):

If the house qualified pre-1993 but did not have a rateable value of less than £1,000 (or £500 outside the Greater London area) on 31 March 1990.

The valuation elements here are:

- the capitalised value of the landlord’s ground rent and the value of his reversion (i.e. the current value of vacant possession of the freehold deferred for the unexpired lease term); and

- 50% of the “marriage” value (the additional value obtained by the tenant’s ability to merge the freehold and leasehold interests) must be paid to the landlord, although the marriage value will be deemed to be nil if the lease has an unexpired term of more than 80 years as at the date of the claim.

Section 9(1C):

If the house qualifies post-1993 (i.e. the claimant must rely on amendments made to the financial limits and/or low rent conditions made by any of the 1993, 1996 or 2002 Acts).

This is broadly the same as a Section 9(1A) valuation except that the freeholder can be compensated for loss in value of other property owned by him (including development value) as a consequence of the severance of the house. from the other property.

We recommend that you obtain specialist valuation advice to calculate the price before serving the Section 5 Notice of Claim (and we can assist you with this). Be aware of online calculators claiming to advise you of the purchase price as they can be misleading.

The freeholder will usually instruct his/her own valuer as well, and usually you will be liable to pay the cost of both valuers.

7. Disputes & Absent Freeholders

Absent Freeholders

If the freeholder fails to serve a counter notice, or to respond at all, or is absent, an application can be made to the County Court for a ‘Declaration’ or ‘Vesting Order’.

The County Court has the jurisdiction to make an order on such terms as it thinks fit provided it is satisfied that the tenant is eligible to buy the freehold. The purchase price is paid into Court and the tenant must also pay the costs of the application.

First Tier Tribunal

The First-Tier Property Tribunal has jurisdiction to determine the purchase price, rent payable, costs and terms of the conveyance, with a right of appeal to the Upper Tribunal (Lands Chamber). There is no deadline for applying to the Tribunal but it is not possible to apply before the earlier of the following:

- The landlord advising the tenant of the purchase price it proposes; and

- Two months after service of the notice of the tenant’s claim in circumstances where the landlord has not advised the tenant of the purchase price.

Download our Free Freehold Purchase Guide

8. Third Parties & Their Rights

Land Registry Notice

The Notice of Claim is registrable as a notice or land charge at the Land Registry. This will protect your claim and rights in the case of a transfer of the freehold.

Personal Representatives

The Personal Representatives of a deceased tenant can make a claim provided that the right is exercised within a period of two years from the date of the grant of probate.

9. Withdrawing the Notice of Claim

The tenant has the right to withdraw his/her notice of claim to buy at any time up to one month following the ascertainment of the purchase price by giving written notice. Thereafter the tenant is bound to complete in accordance with the statutory contract. Service of notice not to proceed has the following consequences:

- The notice of tenant’s claim is no longer of any effect.

- The tenant must compensate the landlord if the notice of tenant’s claim interfered with the landlord’s ability to deal with the house and premises or any adjoining property and caused the landlord any loss.

- The tenant may not serve a further notice of tenant’s claim to buy the freehold for 12 months, although the tenant may serve a notice to acquire an extended lease within this period.

- The tenant remains responsible for paying the landlord’s costs.

10. Freehold Covenants & Estate Charges

Covenant Free Freehold Title?

It is a common misconception that a freehold title is convent free. Even where property is conveyed with a freehold title from inception, a freeholder is entitled to insert terms/covenants in the transfer and many historical freehold properties are subject to restrictive covenants.

Whether you chose the voluntary or statutory route to purchase your freehold, any covenants in the freehold transfer deed will depend on the covenants contained in the freehold title and the lease.

Under Section 10 of the LRA 1967, the freeholder is entitled to include the continuation of covenants that materially enhance the surrounding property.

Under the statutory procedure, any dispute around covenants can be adjudicated by the Property Tribunal. Under the voluntary route, there is no statutory right to have the Tribunal adjudicate the reasonableness of any covenants the freeholder wishes to impose.

Estate Charges

If you live on an estate that is subject to an estate charge for common areas, amenities or services, then it is likely that the freehold transfer deed will contain a covenant to pay an Estate Charge for the continued benefit of those amenities and services.

11. Assigning the Benefit of the Notice of Claim in a Sale or Purchase

A leaseholder must have 2 years registered proprietorship of the leasehold property before exercising their right to a claim for to a statutory enfranchisement.

To get around this qualification issue, the current leaseholder can issue a section 5 notice of claim and then transfer the benefit of the claim to the new purchaser of the property by way of an assignment.

This process can become unnecessarily complicated due to the intricacies of the technicalities.

If you are trying to co-ordinate the sale or purchase of your property together with a freehold purchase claim, we would advise to use the same firm of solicitors that specialise in leasehold enfranchisement to handle both the sale/purchase and the freehold purchase.

This will avoid unnecessary delays, especially as some regular conveyancing solicitors are not familiar with the freehold purchase process.

12. Extending The Lease Option

- This right has been little exercised in recent years because the right to buy the freehold has been expanded to include most houses and is usually the preferred option for the tenant.

- A qualifying tenant of a long lease of a house also has the right to the grant of a new lease for the remainder of the existing term plus a further 50 years.

- No premium is payable, but the lease can contain a modern ground rent, reviewable after 25 years.

- The determination of the modern ground rent cannot be made until 12 months before that rent is to become payable (12 months before the date that would have been the expiry date of the original lease). The modern ground rent is calculated as the letting value of the site, without the house.

- The new lease will be a substitute for the remainder of the original lease, which will be surrendered by operation of law (as determined in Lewis (Jenkins R) & Son v Kerman [1971]).

- The terms of the new lease other than the rent and the term are generally the same as the terms of the existing lease, although these can be changed either by agreement or if something has happened since the date of the existing lease which affects the suitability of a provision of the original lease.

- The provisions of the Landlord and Tenant Act 1927 (LTA 1927) that allow the landlord and tenant to agree conditions for consent to an assignment and the circumstances in which consent may be withheld, do not apply to residential leases.

- A tenant who has been granted a lease extension is entitled to exercise its right to buy the freehold both before and after the end of the term of the original lease.

- Where the notice of tenant’s claim is served after the end of term date of the original lease, the valuation basis is the special valuation basis and section 9(1C) but with modified assumptions, even if the lease qualifies for the original valuation basis.

- If the tenant takes a lease extension but does not choose to enfranchise, the tenant cannot simply extend the lease again when it ends. The tenant does, however, have the right to an assured tenancy.

Advantages of Buying The Freehold

- Obtain freedom from your Freeholder. The lease usually contains restrictive covenants prohibiting various actions on the property. If you breach a covenant you could face a legal action from the freeholder and your lease could potentially be terminated. Alternatively, you could seek the freeholder’s consent at a cost.

- Increase your property’s marketability. Most lenders will not lend against a short lease because of the risk they face in recovering their security. This limits the number of potential buyers and most potential buyers will be reluctant to have to spend additional monies on the property either to extend the lease or to purchase the freehold.

- Save money. Once the remaining lease term reaches 80 years or less, the freehold value will increase substantially and the purchase price will be much higher. It is recommended to purchase the freehold before this point.

- Avoid a takeover by professional freeholder owners. Developers usually sell the freehold to a private company on the open market after they have completed a site. The new owner will aim to make a profit from their investment in any way possible.

- Add value to your property. If your property has a short lease or onerous ground rent payments it is likely to be valued less than freeholds on the same estate.